10 Inspirational People Who Live Kick-Ass Lives by Rejecting Lifestyle Inflation

Real examples of how great life can be when you prioritize living over stuff

Welcome to “Simple Finances,” a series of Tuesday essays about exactly that - simplifying your money. This is a paid subscriber-only essay. If you want in on the fun, subscribe here with a 7-day trial, free e-book, essays, and weekly waste-reducing recipes all for $5 a month / $50 a year. That’s just $0.32 - $0.38 per essay (and it could save you a damn sight more than that) ⬇

“Sleep-Well-at-Night Finance series” essay list

If You Want "Sleep-Well-at-Night" Finances, Stop Listening to The Noise™

You CAN Live an Incredible Life on a Relatively Small Amount of Money

Use the "5 Pillars Rule" to Change Your Relationship with Money Forever

For the last installment of this Sleep-Well-at-Night-Finances series, I was determined to talk about lifestyle inflation but I wasn’t sure how to approach it in a way that you won’t have heard before.

The usual “don’t inflate your lifestyle when you get a pay raise” schtick is important - perhaps the most important topic in personal finance - but there is already so much written about it all over the internet.

IMO, the most impactful way to prove a point is to use real-life stories. So I thought - who do I know who has made a success of their life — whatever that means to them — by rejecting lifestyle inflation?

10 of my friends and family immediately came to mind. People who have achieved everything from realizing their entrepreneurial dreams to traveling to giving their lives to the service of others.

Before we get into it…

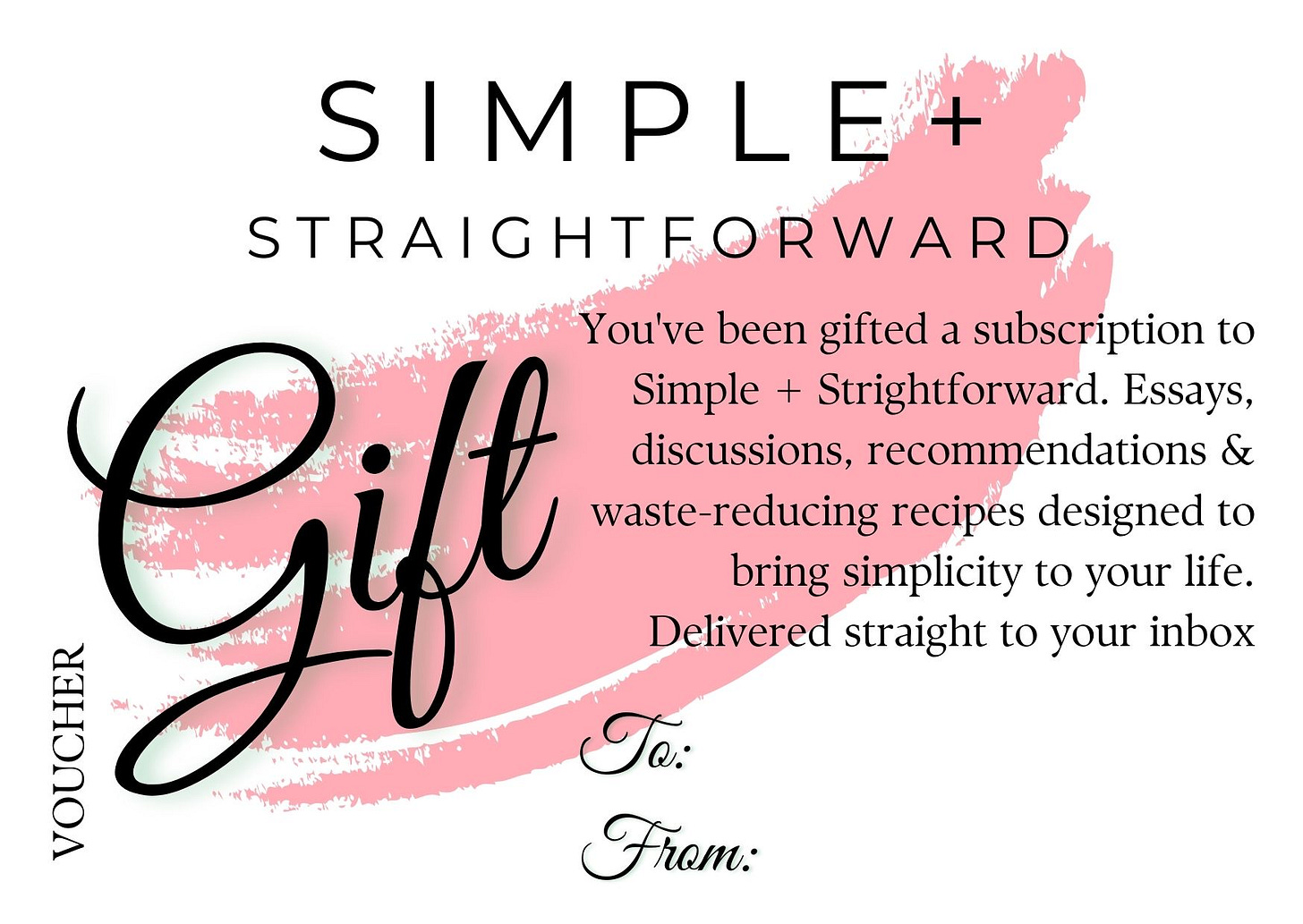

If you’re still looking for a unique, meaningful gift idea, I’ve got it for you. 1 month (for a stocking-filler price of $5) or 1 year ($50) of Simple and Straightforward.

Here’s a printable gift card for those of you gifting S+S this Christmas (and a big thank you from me!)

10 Inspirational People Who Live Kick-Ass Lives by Rejecting Lifestyle Inflation

1. Steve the all-American-boy-turned-Croatian zealot

Steve is the guy who during college assumed he would grow up and do the usual. Get married, get a job, have a kid, and move up both the housing and career ladder. After all, that’s what everyone else around him was doing.

Keep reading with a 7-day free trial

Subscribe to This much I know to keep reading this post and get 7 days of free access to the full post archives.